Using Estate Planning Tools when Markets Are Volatile

Tariffs, persistently high inflation and market volatility can stress even the most carefully designed financial plans.

Tariffs, persistently high inflation and market volatility can stress even the most carefully designed financial plans.

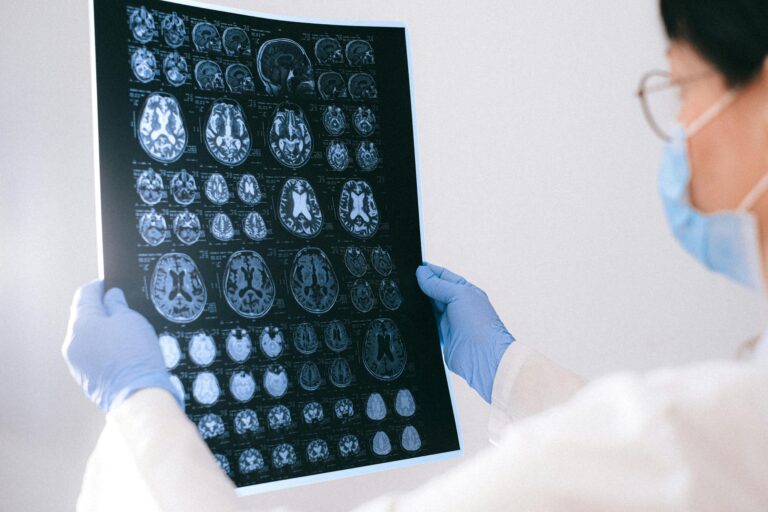

With more Americans pursuing early testing and care planning, Alzheimer’s disease is no longer viewed only as a crisis, but as a condition to prepare for thoughtfully and strategically.

Honest conversations about money build trust and prepare the next generation for future responsibility, especially when tied to a long-term estate plan.

No one expects a sudden medical crisis. However, being prepared can save your family from unnecessary legal battles and emotional distress.

Veterans earned their healthcare benefits through service and sacrifice—knowing how to access these benefits ensures timely care and long-term support.

Older Americans Month reminds us that aging is not a decline but a continuation of growth, contribution and vitality in every stage of life.

For young families, life insurance provides financial security during the most vulnerable years—calculating the right coverage is essential for protecting those who depend on you most.

In a recent Trading Secrets podcast, fashion designer Rebecca Minkoff revealed that she has a special provision in her trust in case she divorces or dies before her husband, Gavin Bellour.

While it can be easy to assume that celebrities would have airtight estate plans, time and time again Hollywood stars have made costly decisions that could have been easily avoided.

Putting your home in a trust can protect your assets while you’re alive and make the ownership transfer easier after your death.