Should I Consider Working with an Elder Law Attorney?

Partnering with an elder law expert is the best way to make life transition easier as seniors age. RC Online’s recent article entitled “Why Is It Ideal for Working with An Elder Law Attorney During Life Transitions?” explains that many people have issues in the stage of life when they’re weak and not feeling well. This can result in health or mobility issues for many family members. The challenges faced by the family can cause financial strain, making lifestyle adjustments difficult, the article says.

Elder law attorneys can help family caregivers understand their loved one’s current situation and provide possible future solutions. This includes planning for situations where a debilitating illness requires long-term care.

Elder law attorneys often see various financial and medical circumstances when representing seniors in court, so their assistance can be extremely valuable when addressing issues, such as managing long-term care needs.

Specialized services for elderly care. Elder law attorneys focused on legal matters concerning older individuals. An elderly law attorney will be familiar with the elder laws of your state and will be able to identify potential conflicts or issues easily. As a result, they’ll be able to take appropriate actions to protect their client’s interests and rights.

Long-term care plan development for seniors. An elder care attorney can provide an objective perspective on the kind of care for their elders. This can help create a longevity plan that meets everyone’s needs.

The attorney will focus on families’ issues and problems as parents or spouses age. They provide legal services to individuals facing aging challenges, such as health care decisions and financial planning. An elder law attorney will consider the required level of care and whether a person can remain in their own home or require long-term nursing care.

Help for families in mediation and education. These are critical parts that play an important role during a family’s transitional phase. Mediation helps families maintain communication, and education provides knowledge for handling various issues.

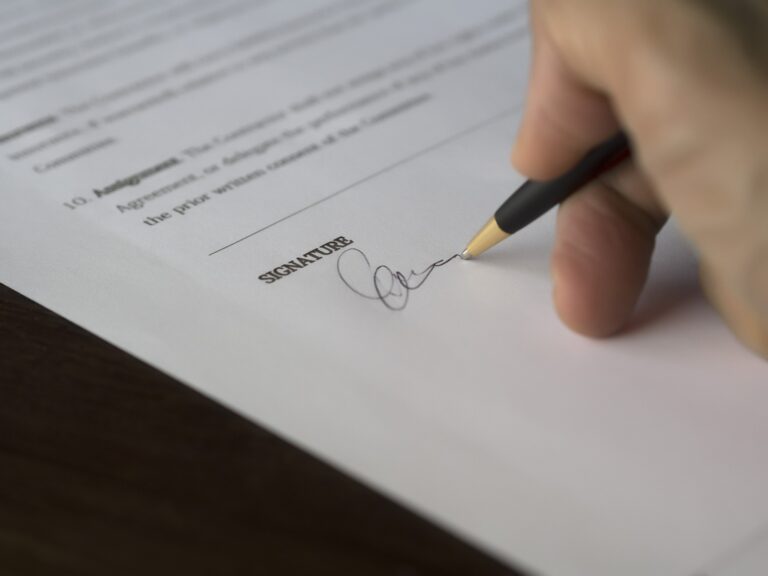

It is important to have legal agreements related to retirement benefits, assets and who will be responsible for caring for an elderly loved one. An elder law attorney can help make these arrangements to prevent family fights and protect assets. They can assist seniors as well as heirs and beneficiaries to prevent losing assets due to financial problems or other circumstances.

Reference: RC Online (Feb. 14, 2023) “Why Is It Ideal for Working with An Elder Law Attorney During Life Transitions?”