States with Most Affordable Long-Term Care?

Seven in 10 people 65 and older will require some type of long-term care during their lifetime. This expense will vary based on the patient’s required level of care, care setting and geographic location, says Think Advisor’s recent article entitled “15 Cheapest States for Long-Term Care: 2020.”

A recent study by Genworth found that the cost for facility and in-home care services increased on average from 1.9% to 3.8% per year from 2004 to 2020. That amounts to $797 annually for home care and as much as $2,542 annually for a private room in a nursing home.

At the current rate, some care costs are more than the 1.8% U.S. inflation rate, Genworth said.

These findings were taken from 14,326 surveys completed this summer by long-term care providers at nursing homes, assisted living facilities, adult day health facilities and home care providers. The survey encompassed 435 regions based on the 384 U.S. Metropolitan Statistical Areas, as defined by the U.S. Office of Management and Budget.

In a follow-up study, Genworth also found that these factors are contributing to rate increases for long-term care:

- Labor shortages

- Personal protective equipment (PPE) costs

- Regulatory changes, such as updated CDC guidelines

- Employee recruitment and retention issues

- Wages demands; and

- Supply and demand.

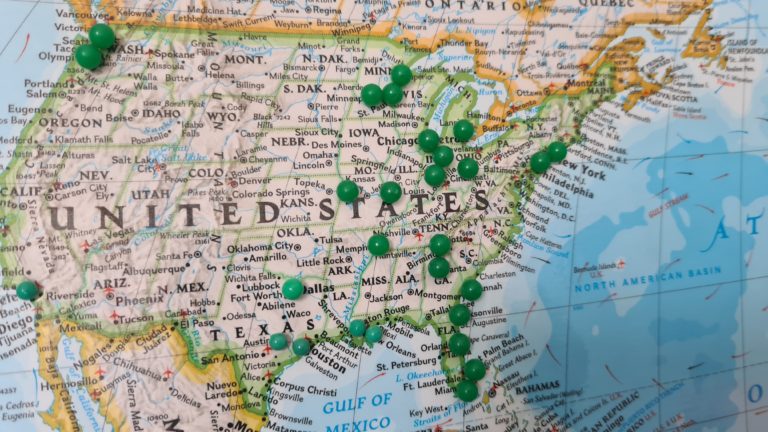

Here are the 15 cheapest states for long-term care, according to Genworth with their average annual cost:

15. Utah: $59,704

14. Kansas: $57,766

13. Iowa: $57,735

12. Kentucky: $57,540

11. South Carolina: $57,413

10. Tennessee: $56,664

9. North Carolina: $56,512

8. Georgia: $53,708

7. Mississippi: $52,461

6. Arkansas: $50,835

5. Oklahoma: $50,641

4. Texas: $48,987

3. Missouri: $48,753

2. Alabama: $48,240

1. Louisiana: $44,811

Reference: Think Advisor (Dec. 14, 2020) “15 Cheapest States for Long-Term Care: 2020”