How to Include Digital Assets in Your Estate Plan

While owning digital assets hasn’t changed the principles of estate planning, it has made the estate pre-planning process more complicated, according to the article “Estate planning and cryptocurrency: 5 tips for leaving your digital assets” from Bankrate. The hurdle is the information needed to retrieve digital assets, including passwords, keys and digital asset locations. There’s no one to call, and the stories of millions in digital assets lost forever are already legendary.

Here are five tips for cryptocurrency owners:

Know where the crypto is held. Cryptocurrency held with a traditional broker or crypto exchange can be handled like other investment accounts, if a beneficiary is named on the accounts or otherwise specified in a will or trust documents. An owner might try to hide the account. However, it generally can be found if the executor knows where the crypto is located.

If crypto assets are self-custodied in an off-chain wallet, and no one knows where the wallet is or its existence, crypto can be hidden and may not be retrievable. A title or probate search will not reveal them; it may be gone forever without the password, private key, or seed phrases.

Understand crypto can easily be lost permanently. Anyone holding crypto on an encrypted hard drive could lose the asset forever, if no one but the owner knows where it is or how to access it. If a hard drive is lost, destroyed, or stolen, or if the key is lost, the crypto is gone.

Provide access to crypto accounts. Whether it’s traditional brokerage accounts or crypto on a hard drive, you’ll need to provide the means and info for your executor or heirs to access these assets upon your passing. The challenge is balancing access with the security of the accounts. There are ways to set up a centralized location to secure all known seed phrases, keys and passphrases and then locate them in the most secure place available. For example, a hard copy list may be stored with other important documents in a fire and waterproof safe.

Another problem is that if your executor is unfamiliar with digital assets, they may not know anything about how digital assets work, making accessing the accounts challenging. You may need to bring them into the digital world as part of your estate planning process.

Protect access to accounts with best practices. If crypto is sent to another person, it’s basically unrecoverable. Don’t include this information in your will, as it becomes a public document upon going through probate. It may be better to secure digital vaults or use reliable, reputable third-party services to store access information. Be careful about providing access to family members who may take advantage of their digital fluency before the estate plan is settled.

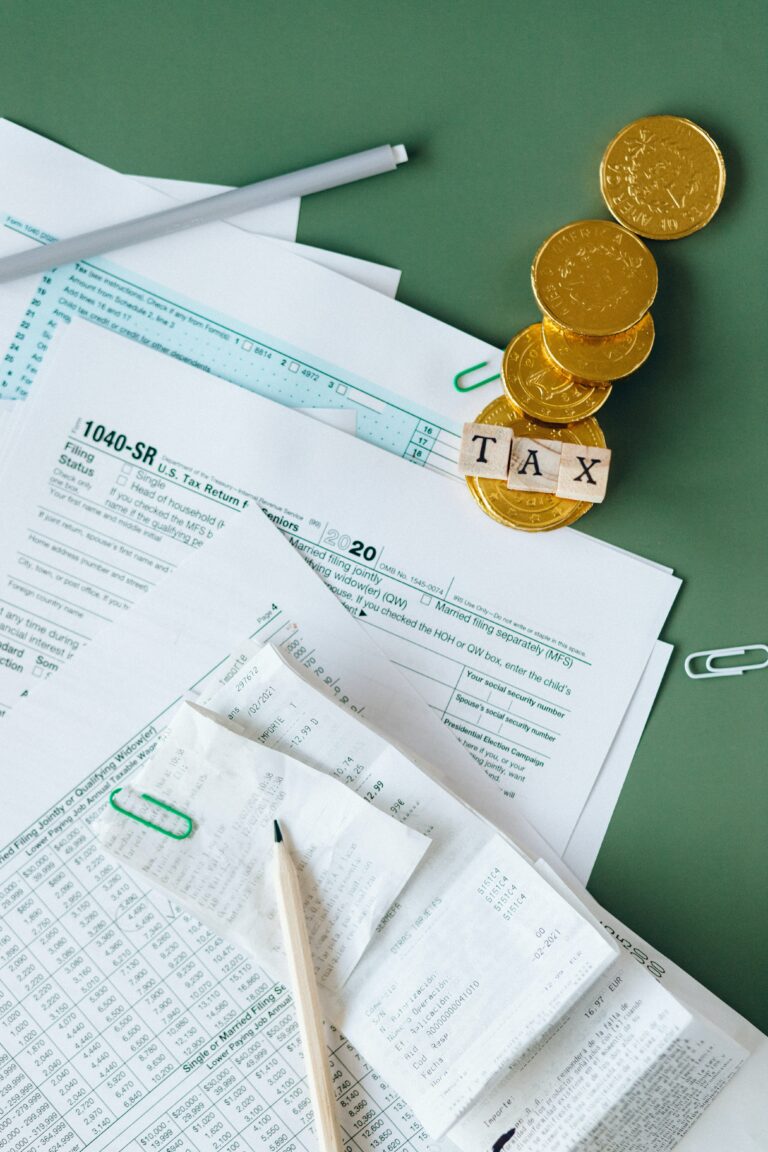

Don’t forget cryptocurrency is taxable. Any realized capital gain is taxable, and so are purchases using crypto when the value of the goods is worth more than the purchase price of the crypto. If the estate is over the federal or state exemption level, it can owe estate taxes, even when the crypto is hidden. Tax implications, including tracking the cost basis and gain and loss metrics, are especially important during the asset transition phase. Executors dealing with crypto must be careful to declare the estate’s taxable gains and losses. The estate must meet all tax obligations, crypto and traditional assets included.

Speak with an experienced estate planning attorney about how your state’s laws govern cryptocurrency and digital assets as part of a comprehensive estate plan.

Reference: Bankrate (September 5, 2023) “Estate planning and cryptocurrency: 5 tips for leaving your digital assets”