Can a Trust Be Created to Protect a Pet?

For one woman in the middle of preparing for a no-contest divorce, the idea of a pet trust was a novel one. She was estranged from her sister and didn’t want her ex-husband to gain custody of her seven horses, three cats and five dogs if she died or became incapacitated. Who would care for her beloved animals?

The solution, as described in the article “Create a Pet Estate Plan for Your Fur Family” from AARP, was to form a pet trust, a legally sanctioned arrangement providing for the care and maintenance of companion animals in the event of a person’s disability or death.

Creating a pet trust and establishing a long-term plan requires state-specific paperwork and funding mechanisms, which are different from leaving property and assets to human family members. An experienced estate planning attorney is needed to ensure that the protections in place will work.

Shelters nationally are seeing a big increase in animals being surrendered because of COVID or people who are simply not able to take care of their pets. Suddenly, a companion pet accustomed to being near its human owner 24/7 is left alone in a shelter cage.

When pet parents have not made plans for their pets, more often than not these pets end up in shelters. However, not all animal shelters are no-kill shelters. In 2021, data from Best Friends Animal Society shows an increase in the number of pets euthanized in shelters for the first time in five years.

For pet owners who can’t identify a caregiver for their companions, the best option may be to find an animal sanctuary or a shelter providing perpetual care.

The woman described above had a pet trust created and funded it with a long-term care and life insurance policy. The trust was designed with a board of three trustees to check and balance one another to determine how the money will be allocated and what will happen to her assets. Her horse property could be sold, or a long-term student or trainer could be brought in to run her barn.

It is not legally possible to leave money directly to an animal, so setting up a trust with one trustee or a board is the best way to ensure that care will be given until the animals themselves pass away.

The stand-alone pet trust (which is a living trust) exists from the moment it is created. A dedicated bank account may be set up in the name of the pet trust or it could be named as the beneficiary of a life insurance or retirement plan.

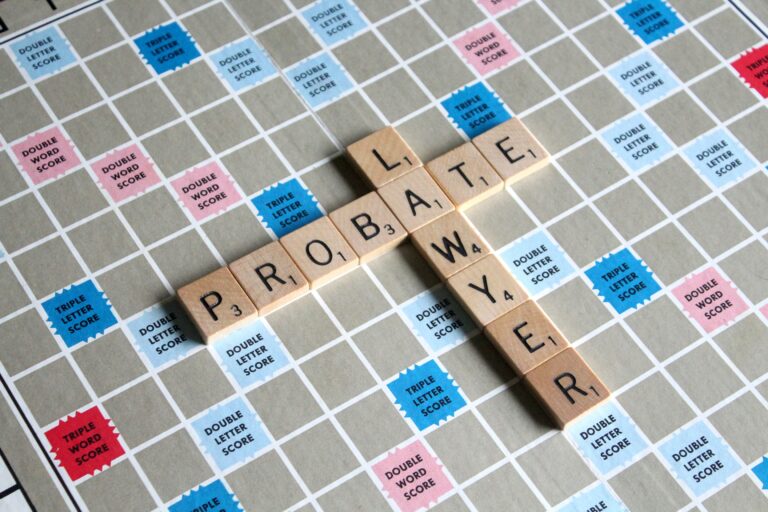

A pet trust can also be set up within a larger trust, like a drawer within a dresser. The trust won’t kick in until death. These plans prevent the type of delays typical with probate but is problematic if the person becomes incapacitated.

If a trust is created as part of another trust, there can still be delays in accessing the month, if the pet trust is getting money from the larger trust.

With costlier animals likes horses and exotic birds, any delay in funding could be catastrophic.

How long will your pet live? A parrot could live for 80 years, which would need an endowment to invest assets and earn income over decades. A long-living pet also needs a succession of caregivers, as a tortoise with a 150 year lifespan will outlive more than one caregiver.

Reference: AARP (Sep. 14, 2022) “Create a Pet Estate Plan for Your Fur Family”