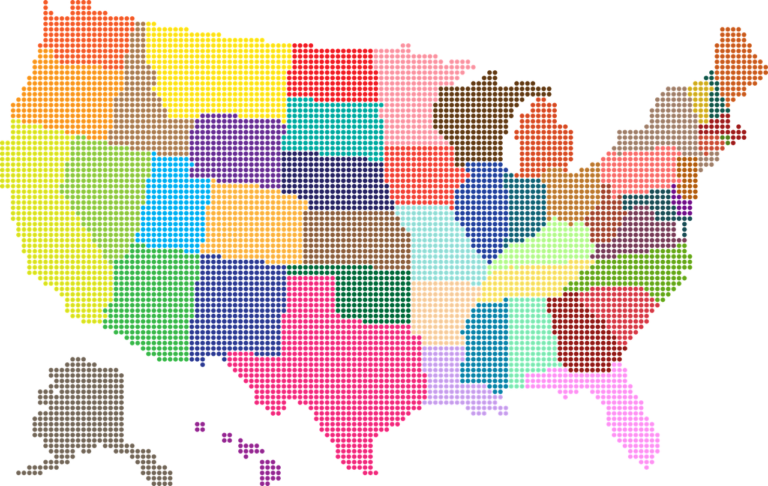

State Laws Have an Impact on Your Estate

I am a resident of Florida. I would like to leave my condo in Florida to my friend’s daughter, who I consider my stepdaughter, after my death. She is a resident of New Jersey and they would use the condo as a vacation home. Will she be considered my daughter for tax purposes, and which state’s tax laws will count?